IMPORTANT: due to community feedback, this newsletter will be available for paid subscribers only and will remain completely free for the CryptoRise Group members, and sent everyday inside the group.

Welcome to our daily market review where we will delve into current market dynamics and prepare our plan for the day.

What are we watching today ?

Assets to Watch: Today we'll closely take a look at Bitcoin, Ethereum, SPX and EURUSD.

Key Levels: Identifying and analyzing key levels that are crucial for these assets.

Today's Economic News and Events: Bringing you the latest updates and economic events of the day that could impact the market and influence your trading.

🔎 Remember that all those informations are or have been shared and can be discussed live with us, and our community, which you can join here:

https://whop.com/marketplace/cryptorisegroup/

Assets to watch

Let’s focus on major assets, key levels and what could be the plans for today:

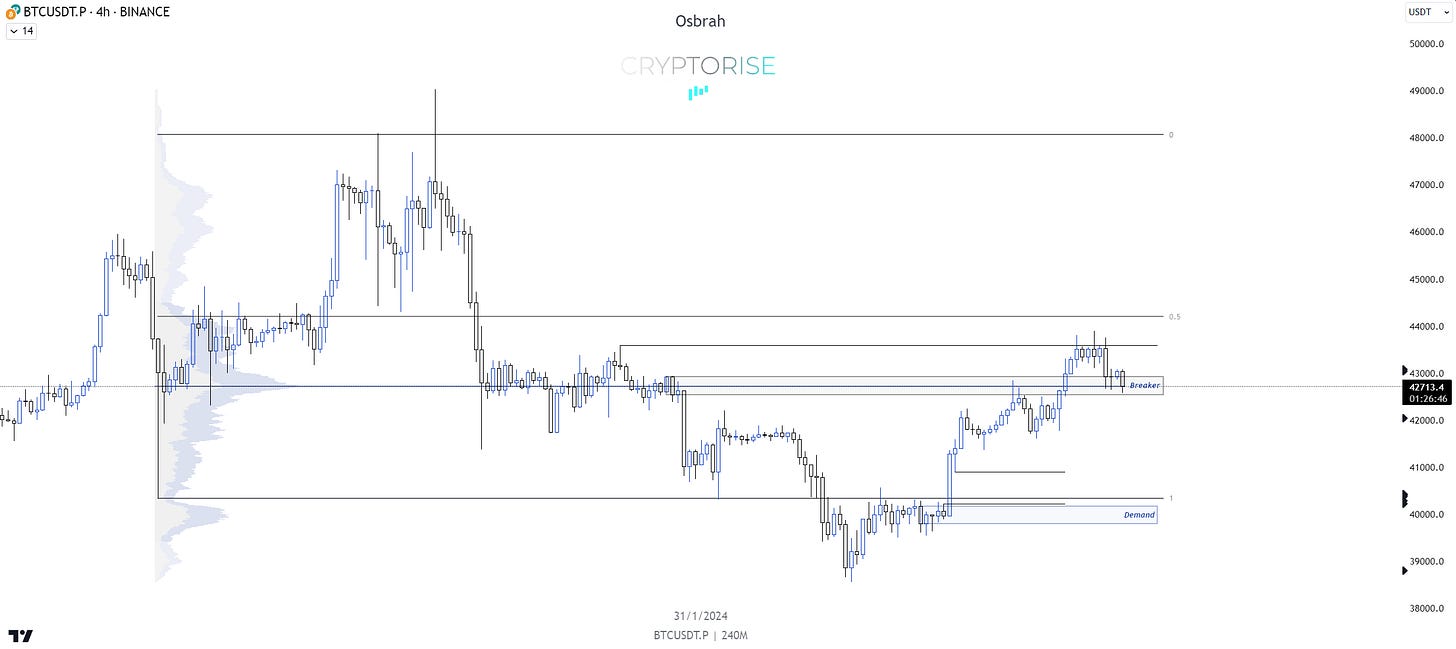

Bitcoin

Bitcoin continued its bullish rally in the previous session, flirting with the $44,000 level, which is closely watched by investors and traders. Indeed, it touched $43,900 before experiencing a series of spot Bitcoin sales. We also lost the Monday high after failing in three attempts to overtake the previous peak (SFP), which prompted us to short at $43,600.

On the H4 chart, we observe:

A potential breaker block formed around $42,500, which could serve as support.

An FVG from $41,000 to $40,200. The $40,200 mark is the starting point of the bullish rally.

A demand zone under the range low: suggesting a potential sweep & retest before a bullish continuation targeting the range high.

Zooming into LTF movements, the observation remains clear and simple:

The loss of the Monday high, after three failed attempts to flip the $44,000, logically could lead us to the Monday low.

We've formed a gap and imbalance, within which we also have the daily trend, at $42,250.

Our liquidation clusters provide interesting data:

Intraday, the cluster is around $42,500.

In HTF, liquidations are around $41,500 - $40,000.

Ethereum

Following BTC's footsteps, Ethereum experienced its first artificial pump, fueled by a "prediction" from SCB* about an approval of an ETH Spot ETF for May. This was accompanied by a price prediction: $4,000.

The market reacted, propelling the price close to $2,400 before retracing the entire movement.

The price halted sharply in front of the monthly VWAP at $2,390.

We've retraced the entire rise without finding support at the Monday high, indicating the movement was completely artificial.

The next interesting level logically is around the Monday low: $2,233, where we also find our Golden Pocket, OTE, and the point of control, supported by a demand zone just below.

Extreme caution is warranted as we still have EQLs waiting to be reclaimed. The $2,100 remains the major level to watch, in my opinion.

*Source: SCB prediction about ETF Spot for ETH

S&P500

In traditional finance, the SPX is starting to cool off. Remember, we mentioned oscillator overheating after a parabolic move and price discovery a few days ago. Patience is key here:

Aside from the "magnificent 7," corporate earnings are lackluster, evidenced by the wave of massive layoffs planned by many companies, like Microsoft or UPS.

We're still waiting to retest the previous ATH and fill the FVG around 4,810 - 4,820 points.

We also have the mid-range and the daily trend located in a very interesting zone, just below the levels mentioned above.

The trend remains bullish, but recent data on inflation and average results from many companies, leading to massive layoffs and workforce reductions, calls for caution. Indeed, a accumulation of bad news could potentially lead the SPX to tumble at some point.

EURUSD

In Forex, we focused on EURUSD at the start of the week. The reasoning was explained in detail during live sessions, summarized as follows:

Technically, we are in a very interesting zone: we've filled a daily FVG and retested a significant demand zone. The target is simply the liquidity cluster around 1.10.

The European Central Bank maintains a firm stance on its monetary policy, whereas the Fed appears more "flexible."

The plan is to play the narrative of a pause in the Fed's rate hikes, which would automatically lead to a weakening of the dollar against the euro. However, caution is advised regarding Jerome Powell's speech, which is expected to be hawkish given recent economic data.

Economic Events

Extreme caution is advised today. Indeed, we are facing a series of crucial data ahead of the much-anticipated FOMC and the speech by Fed Chair Jerome Powell.

Eyes on Non-Farm data a 2:15 PM UTC+2 & FOMC Statement at 8:00 PM UTC+2

The details of my reasoning on how to approach the day have been shared within CRG, and I invite you to refer to it.

Among other things, I align with the estimates and expect the rates to be maintained at the current level, followed by a pessimistic discourse regarding persistent inflation and a resilient job market (recent layoffs not yet reflected in the data we have).

That’s it for today !

Remember that none of the above is financial advice and the sole purpose is to give you insights about the current market conditions.

Thanks for reading.