📊 Trading Strategy: Volume Profile

In this small course, we'll explain what is volume profile and how to use this simple tool to find confluence.

📚 This brief course about a tool I personally use will highlight how to properly setup and use volume profile and volume node areas to find confluence, helping you to improve your trading entry and exit points.

We will briefly and simply cover the following concepts:

- Whats is Volume Profile

- Value Area Low (VaL)

- Value Area High (VaH)

- Point of Control (PoC)

- How to use VP

🔎 Remember that all those informations are or have been shared and can be discussed live with us, and our community, which you can join here:

https://whop.com/marketplace/cryptorisegroup/

Volume Profile

What is VP

The volume profile is a technical analysis tool that allows traders to visualize price levels at which transactions have been executed, based on the volume traded at each price level. This allows traders to better understand where areas of interest for buyers and sellers lie.

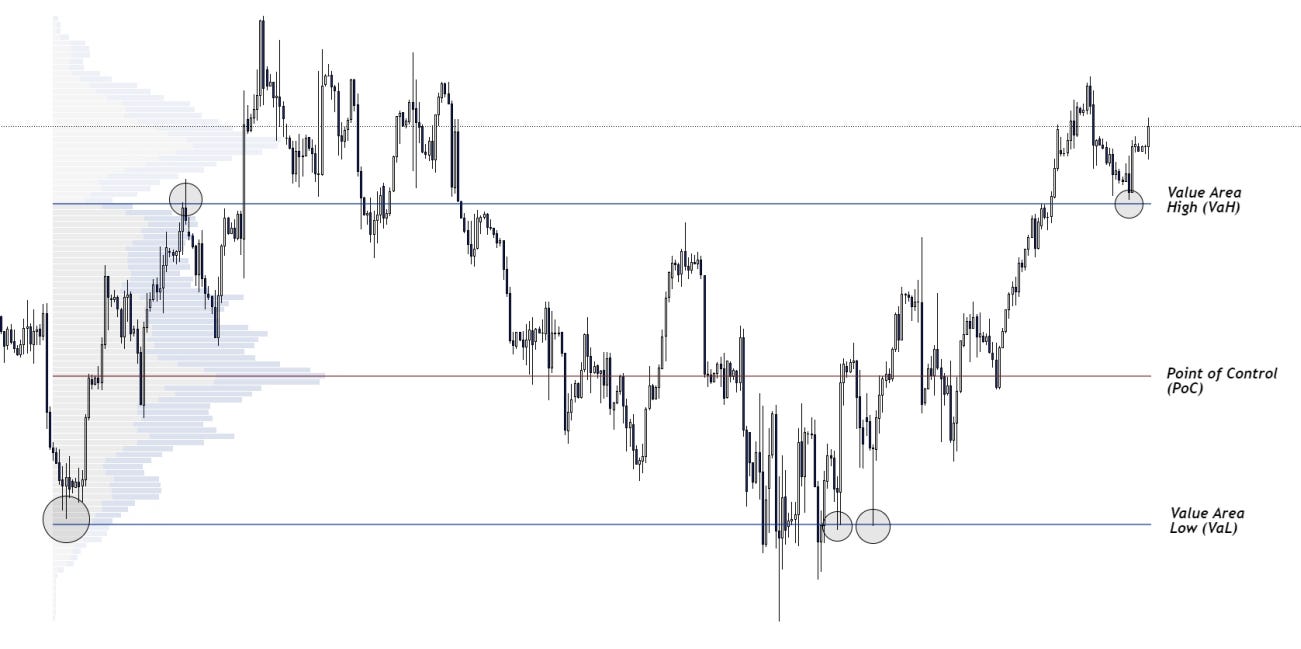

The volume profile is composed of three key elements :

Value area low (VAL)

Value area high (VAH)

Point of control (POC)

The VAL represents the lowest price level of the value area, defined as the area that encompasses 70% of transactions made during a given period. The VAH represents the highest price level of the value area.

Finally, the POC represents the price level where the volume of transactions is the highest.

Utility of VP

The volume profile can be used to identify potential support and resistance areas. For example, if the POC is located near a price level previously identified as support or resistance, this may indicate that this level is significant for the market and could potentially influence future trader behavior.

It can also be used to identify market trends. If the POC is increasing compared to previous sessions, this may indicate that buyers are increasingly present in the market, while if the POC is decreasing, this may indicate that sellers have taken control.

In summary, the volume profile is a powerful technical analysis tool that can help traders better understand value areas in the market, as well as potential support and resistance areas. By using the information provided by the VAL, VAH, and POC, traders can make more informed decisions when trading financial assets.

Value Area Low (VAL)

The Value Area Low (VAL) is an important concept in volume profile analysis : it is the lowest price level in the value area. The VAL provides traders with information about where price has found support in the past. If price falls to the VAL and bounces higher, this may indicate that buyers are entering the market at this level.

The VAL can also be used as a potential entry or exit point for traders. For example, a trader may look to enter a long position when price reaches the VAL, with a stop loss order placed just below the VAL in case price breaks down. Alternatively, a trader may look to exit a long position when price reaches the VAH, with a profit target set at the VAL.

In summary, the VAL is important in volume profile analysis as it provides traders with valuable information about where price has found support in the past, and where potential entry and exit points may exist in the future.

Value Area High (VAH)

The Value Area High (VAH) is the highest price level in the value area. It provides traders with information about where price has encountered resistance in the past. If price reaches the VAH and pulls back, this may indicate that sellers are entering the market at this level.

The VAH can also be used as a potential exit point for traders who have entered long positions. If price reaches the VAH, a trader may choose to exit their long position and take profits, with a stop loss order placed just above the VAH in case price continues to move higher.

In addition, the VAH can be used in combination with other technical analysis tools to confirm or invalidate potential breakout or reversal signals. For example, if price breaks through the VAH and a bullish candlestick pattern forms, this may indicate that buyers are in control and that the market is likely to continue higher.

In summary, the VAH is important in volume profile analysis as it provides traders with valuable information about where price has encountered resistance in the past, and where potential exit points may exist in the future.

Point of Control (POC)

The POC provides traders with information about where the market has spent the most time trading, and therefore where the market perceives fair value to be. If price is trading above the POC, this may indicate that buyers are willing to pay a premium for the asset. Conversely, if price is trading below the POC, this may indicate that sellers are willing to accept a lower price for the asset.

In addition, the POC can be used in combination with other technical analysis tools to identify potential levels of support or resistance. For example, if the POC is located near a key support level, this may provide additional confirmation that the support level is significant for the market. It also gives indication about where traders can enter a position and in which direction, for example on PoC breakout to the upside or to the downside.

In summary, the POC is an important concept in volume profile analysis as it provides traders with valuable information about where the market perceives fair value to be.

How to use VP (Settings)

You can use volume profile with Fixed Range Volume Profile tool. It will allow you to define the range you want to focus on.

It is useful for day trading or scalping for example, as you can define the range you want to play within. Just select the tool, then select the range of price where you want to define the VP and operate in.

Settings I personally use:

Reminder

It's important to note that Volume Profile is just a technical analysis tool among many others. Traders must use a comprehensive approach, taking into account several factors such as market trends, economic and geopolitical events, as well as the risks associated with open positions.

Thanks for reading.

I appreciate your support.

Sincerely yours.

Osbrah